Two days ago, markets exhaled a collective breath of relief when China published its monthly data dump which disclosed that in addition to beating (almost) across the board for retail sales, industrial output, and fixed investment, the country's GDP came well above expectations of 4.50%, printing at a 4.90% increase YoY.

This was good news for a world starved for any positive developments out of China, and Chinese assets promptly bounced (if only to sink shortly after as attention return to China's rapidly disintegrating property sector). There is just one problem: as with every economic data coming out of China (and lately the US, as well), this was a lie.

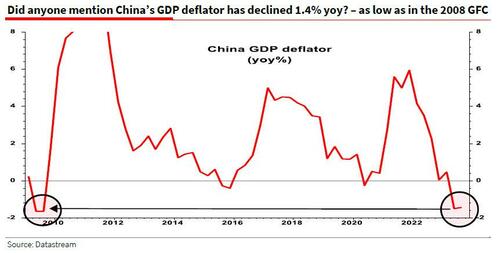

While it is true that reported real GDP was 4.9%, what SocGen's Albert Edwards points out in his latest Global Strategy Weekly note is that this was only possible because the Chinese economy remained in deflation in Q3, hardly an indication of economic prosperity.

As Edwards explains, the 4.9% upside surprise on real GDP was "only achieved because of the surprisingly sharp 1.4% fall in the GDP deflator – that was then added to weak 3.5% nominal GDP growth."

This is a problem because as the SocGen strategist observes next, "nominal GDP growth in China at 3.5% (red line in chart below) is far lower than the (more…)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  TRON

TRON  Stellar

Stellar  Litecoin

Litecoin  Monero

Monero  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Maker

Maker  Tezos

Tezos  Zcash

Zcash  NEO

NEO  Dash

Dash  Decred

Decred  0x Protocol

0x Protocol  NEM

NEM  Ontology

Ontology  Lisk

Lisk  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold