Authored by Rystad Energy via oilprice.com,

- EU's clean tech spending lags behind China and the US, with China investing $390 billion in 2023 compared to the EU's $125 billion

- The US' Inflation Reduction Act is expected to boost clean energy investments, while the EU's spending is plateauing

- The upcoming EU elections could result in a political shift to the right, which could jeopardize the EU's climate change and energy transition goals.

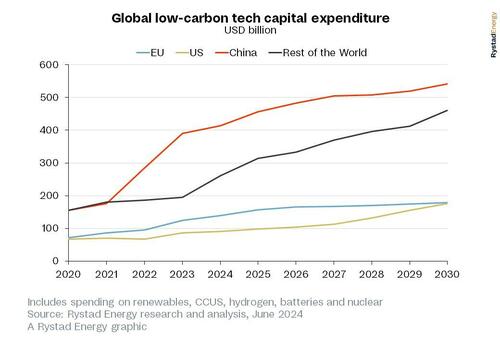

The European Union (EU) is set to fall far behind its ambitious energy transition targets for renewable energy, clean technology capacity and domestic supply chain investments, according to Rystad Energy research and modeling. The bloc’s capital investments (capex) in clean technologies – including renewables, carbon capture, utilization and storage (CCUS), hydrogen, batteries and nuclear – totaled $125 billion in 2023, dwarfed by China’s spending of $390 billion in the same sectors. The US is currently behind the EU in annual clean-tech spending, investing $86 billion in 2023, but the Inflation Reduction Act is set to spur investments while the EU’s spending will plateau in the years to come. The US will all but match the EU in total clean energy spending in 2030, and accelerate past the bloc in the ensuing years.

The Net-Zero Industry Act (NZIA) was passed by the EU earlier this year as a roadmap for the Union to meet its lofty goal of cutting emissions by 92% compared to 1990 levels by 2040 and reaching net zero by 2050. As a direct response to the US’ landmark Inflation Reduction Act, the EU has set ambitious targets through the NZIA to support nascent industries, homeshore supply chains and position the bloc as an attractive investment location through supplier incentives. However, the cleantech investment landscape in the EU is a contrasting story of ambition versus reality, and another dose of reality could be coming soon.

The EU elections are right around the corner, and the results are likely to have sweeping impacts on the bloc’s policy landscape. Many predict a political shift to the right following similar recent results in national elections, which could usher in a period of heightened Euroscepticism and decreased appetite to tackle climate change and the energy transition from a continental perspective. Next year is a pivotal one for the EU’s climate change progress, with reevaluations of its nationally determined contributions (NDC) and emissions goals expected, so significant political upheaval could have a long-lasting impact.

The stakes are high in the upcoming EU election – as the EU strives to remain competitive in the global clean tech market, the rising right-wing populist wave could critically heighten the EU’s risk of falling further behind the US and China. The next few years are critical, and hesitancy or a lack of cohesion could see the bloc lagging its counterparts for decades to come. As things stand, the EU is losing ground and is highly unlikely to reach its lofty goals

Lars Nitter Havro, Senior Energy Systems Analyst, Rystad Energy.

The NZIA sets forth ambitious targets and provisions to boost the production and deployment of key clean technologies, including batteries, CCUS and hydrogen electrolyzers, as part of the EU's broader emissions reduction and energy security goals. The Act outlines production targets and regulatory frameworks to accelerate the development and commercialization of these technologies, but only the battery sector is showing genuine (more…)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  TRON

TRON  Stellar

Stellar  Litecoin

Litecoin  Monero

Monero  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Maker

Maker  Zcash

Zcash  Tezos

Tezos  NEO

NEO  Dash

Dash  Decred

Decred  0x Protocol

0x Protocol  NEM

NEM  Ontology

Ontology  Lisk

Lisk  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold